By OrderSincerely, [ ] Marcus A. Lemonis

Executive Chairman of the Board of Directors Midvale, Utah

[ ], 2024 | | | | | | | | Allison H. Abraham

Chairwoman of the Board

| | | Jonathan E. Johnson III

Director & Chief Executive Officer2024 Proxy Statement | iii

|

Midvale, Utah

March [23], 2022

TABLE OF CONTENTS Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 12, 2022.21, 2024. The Notice of Annual Meeting, Proxy Statement, and Annual Report on Form 10-K for the fiscal year

ended December 31, 20212023 are available athttp: https://www.overstock.com/proxy.investors.beyond.com/financials/annual-reports. Whether or not you plan to virtually attend the meeting, please submit your proxy via the internet, telephone, or by completing, signing, dating, and returning your Proxy Card in the enclosed prepaid business reply envelope. iv | 2024 Proxy Statement | | | | | | |

TABLE OF CONTENTS Overstock.com,Table of Contents

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annexes

| | | | | | | | | | | | | | | |

| | | | | | 2024 Proxy Statement | v |

TABLE OF CONTENTS Cautionary Note Regarding Forward-Looking Statements This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include all statements other than statements of historical fact, including but not limited to statements regarding our goals, commitments, strategies, and our executive compensation program. Additional information regarding factors that could materially affect results and the accuracy of the forward-looking statements contained herein may be found in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 23, 2024, and in our subsequent filings with the SEC. vi | 2024 Proxy Statement | | | | | | |

TABLE OF CONTENTS PRELIMINARY PROXY MATERIALS, DATED MARCH 15, 2024

SUBJECT TO COMPLETION Beyond, Inc. 799 W. Coliseum Way

Midvale, Utah 84047 2024 Annual Meeting of Stockholders

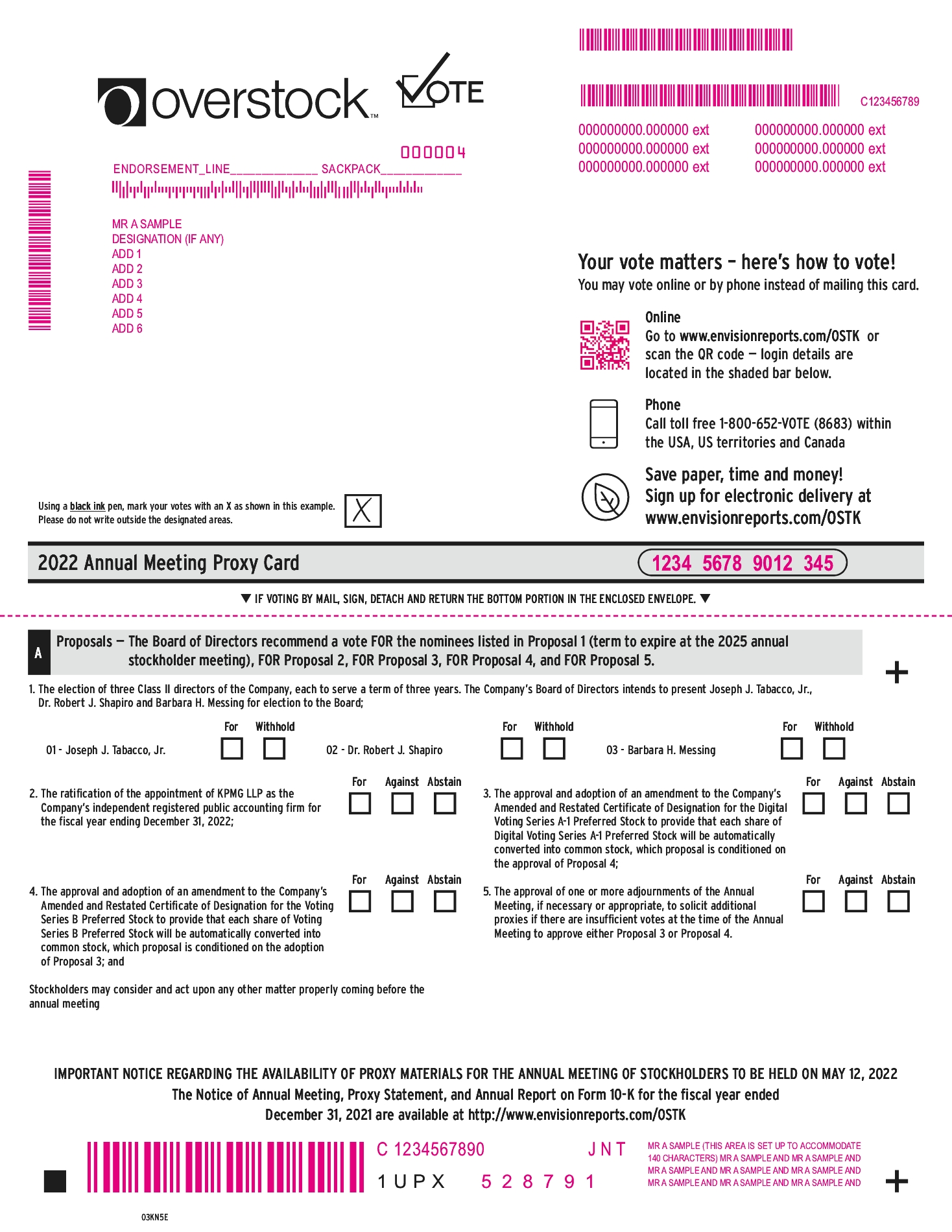

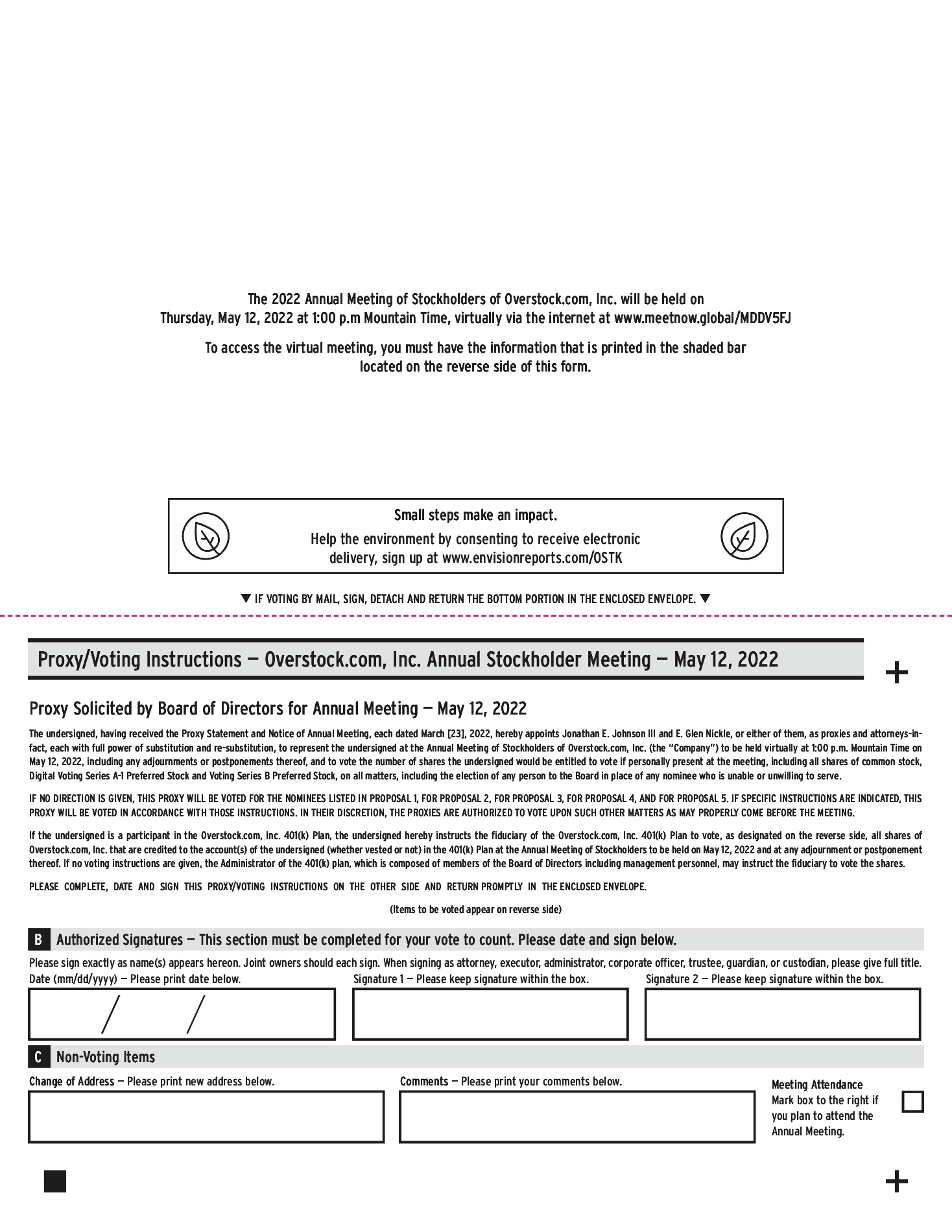

To Be Held at 1:12:00 p.m. Mountain Time on May 12, 202221, 2024 General Our Board of Directors (the “Board”) is soliciting proxies for the 20222024 Annual Meeting of Stockholders of Overstock.com,Beyond, Inc. (“Overstock,Beyond,” the “Company,” “we” or “our”), which will be held at 1:12:00 p.m. Mountain Time on May 12, 2022.21, 2024 (the “Annual Meeting”). The meetingAnnual Meeting will be a virtual stockholder meeting conducted via live audio webcast through which you can examine the list of registered stockholders entitled to vote at the meeting, submit questions and vote online. The meeting andYou can access the list of registered stockholders can be accessedAnnual Meeting by visitingwww.meetnow.global/MDDV5FJ https://meetnow.global/M7X9UAS and entering your control number (which can be found on your proxy card or notice of internet availability mailed to you). This Proxy Statement contains important information for you to consider when deciding how to vote on the matters before the meeting. We have elected to provide access to our proxy materials to our stockholders via the internet. Accordingly, a notice of internet availability of proxy materials has beenwill be mailed to most of our stockholders, while otherstockholders. Other stockholders have requested and will instead receivedreceive paper copies of the proxy materials accessible via the internet. Stockholders who received theThe notice of internet availability of proxy materials cancontains instructions on how to access the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”) via the internet. The notice also contains instructions on how to request a paper copy of our proxy materials, at http://www.overstock.com/proxy or request thatincluding this Proxy Statement, our 2023 Form 10-K and a printed set of the proxy materials be sent to them by following the instructions set forth on the notice of internet availabilityform of proxy materials.card or voting instruction card, as applicable. Please follow the instructions on the notice of internet availability mailed to you for details on how to request future proxy materials be sent to you electronically by e-mail or in printed form by mail on an ongoing basis. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials or a link to a special website to access our proxy materials. Your election to receive proxy materials by e-mail or printed form by mail will remain in effect until you terminate it. Choosing to receive future proxy materials by e-mail will allow us to provide you with the proxy materials you need in a timelier manner, will save us the cost of printing and mailing documents to you, and be more environmentally responsible. Our principal offices are located at 799 W. Coliseum Way, Midvale, Utah 84047,We will send or make available to stockholders proxy materials, which include this Proxy Statement, the proxy card, and the 2023 Form 10-K on or about [ ], 2024.

Chief Executive Officers The Company had two Chief Executive Officers (“CEO’s”) during 2023: Jonathan E. Johnson III, who served as CEO through November 6, 2023, and David J. Nielsen, who served as interim CEO from November 6, 2023 until February, 20, 2024. On February 20, 2024, Marcus A. Lemonis was named our telephone number is (801) 947-3100.Executive Chairman of the Board of Directors, Chandra Holt was named our Division CEO, Bed Bath & Beyond, and David J. Nielsen was named our Division CEO, Overstock. | | | | | | 2024 Proxy Statement | 1 |

TABLE OF CONTENTS Corporate Name Change and Stock Exchange Listing Transfer Effective November 6, 2023, we changed our corporate name from Overstock.com, Inc. to Beyond, Inc. Concurrently, with this corporate name change, we transferred the listing of our common stock from the Nasdaq Global Market to the New York Stock Exchange (“NYSE”), and changed our ticker symbol from OSTK to BYON. Following this corporate name change, we continued to operate our furniture and home furnishings ecommerce business under the Bed Bath & Beyond brand. The corporate name change followed our June 28, 2023 acquisition of the Bed Bath & Beyond brand and associated intellectual property. Record Date and Voting Securities The Board set March 14, 202225, 2024 as the record date for the meeting (“Record Date”). Stockholders who owned shares of our common stock our Digital Voting Series A-1 Preferred Stock (“Series A-1 Preferred Stock”), and our Voting Series B Preferred Stock (“Series B Preferred Stock” and, together with the common stock and Series A-1 Preferred Stock, collectively, our “Voting Shares”) at the close of business on that datethe Record Date are entitled to virtually attend and vote at the meeting. Each Voting Shareshare is entitled to one vote. At the Record Date, a total of [47,755,444] Voting Shares[45,734,750] shares of stock were outstanding and entitled to vote at the meeting, consisting of 4,203,576 shares of Series A-1 Preferred Stock, 356,713 shares of Series B Preferred Stock, and [43,195,155] shares of common stock.meeting. A majority of the outstanding Voting Sharesshares of stock present at the meeting or by proxy will constitute a quorum for the transaction of business. With respect to the Series A-1 Preferred Proposal, a quorum will also require a majority of the outstanding shares of Series A-1 Preferred Stock and with respect to the Series B Preferred Proposal, a quorum will also require a majority of the outstanding shares of Series B Preferred Stock. If you were a stockholder as of the close of business on the Record Date and have a control number, you may vote at and ask questions during the meeting by following the instructions available on the virtual meeting website. YouWhether or not you plan to attend the meeting, you may still submit your vote in advance of the meeting via the internet or by telephone or proxy card as instructed in the Proxy Statement and notice of internet availability. If you do not have your control number, you may attend the Annual Meeting as a guest, (non-stockholder), but you will not have the option to vote your shares during the meeting or ask questions during the virtual meeting. | | | | | | 2022 Proxy Statement | i

|

TABLE OF CONTENTS

Attendance and Participation To access the virtual meeting please visit www.meetnow.global/MDDV5FJhttps://meetnow.global/M7X9UAS. To login to the virtual meeting, you have two options: Join as a “Guest” or Join as a “Stockholder”. If you join as a “Stockholder” you will be required to enter a control number. Your control number can be found on your proxy card, voter instruction form, (VIF), or notice of internet availability mailed to you. ClosedWe will provide closed captioning will be provided for the duration of the virtual meeting. TheWe will make available for inspection the list of our registered stockholders entitled to vote at the Annual Meeting will be available for viewing by stockholders during the Annual Meeting for any purpose germane to the meeting by accessing the virtual meeting website at www.meetnow.global/MDDV5FJ. The list will also be available for inspection for at least 10 days prior to the Annual Meeting at the Company’s principal place of business located at 799 W. Coliseum Way, Midvale, Utah 84047. An audio replay of the virtual meeting will be available at http://investors.overstock.com within three days of the meeting date. If you encounter any technical difficulties with the virtual meeting website on the meeting day during either the check-in or the meeting itself, please call the technical support number at (781) 575-2748 or toll-free at (888) 724-2416. The technical support number will also be posted on the virtual meeting website. Proxy Materials

Voting materials, which include this Proxy Statement, the proxy card, and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “2021 Form 10-K”) are first being sent or made available to stockholders on or about March [23], 2022.

The date of this Proxy Statement is March [23], 2022.

ii 2 | 2022 2024 Proxy Statement

| | | | | | |

TABLE OF CONTENTS

| | | | | | | | | | | | Proposal 1

| | | | | | | | Proposal 2

| | | | | | | | Proposal 3

| | | | | | | | Proposal 4

| | | | | | | | Proposal 5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 2022 Proxy Statement | iii

|

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters

What is the purpose of the Annual Meeting? At our Annual Meeting, stockholders will act upon the matters outlined in the meeting notice provided with this Proxy Statement, including: theThe election of three Class II directors;two directors of the Company. The Company’s Board of Directors intends to present Joanna C. Burkey and Barclay F. Corbus for election to the Board;

theThe ratification of our Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm for 2022;

• | the approval and adoption of an amendment to the Company’s Amended and Restated Certificate of Designation for the Series A-1 Preferred Stock, as set forth in Appendix A, to provide that each share of Digital Voting Series A-1 Preferred Stock will be automatically converted into 0.90 of a share of common stock (the “Series A-1 Preferred Proposal”), which proposal is conditioned on the adoption of the Series B Preferred Proposal (as defined below);

|

• | the approval and adoption of an amendment to the Company’s Amended and Restated Certificate of Designation for the Series B Preferred Stock, as set forth in Appendix B, to provide that each share of Voting Series B Preferred Stock will be automatically converted into 0.90 of a share of common stock (the “Series B Preferred Proposal”), which proposal is conditioned on the adoption of the Series A-1 Preferred Proposal; and

|

the approval of one or more adjournments of the Annual Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Annual Meeting to approve either the Series A-1 Preferred Proposal or the Series B Preferred Proposal (the “Adjournment Proposal”).

Who can vote at the Annual Meeting?

Stockholders of record who owned Voting Shares at the close of business on March 14, 2022 (the “Record Date”) may virtually attend and vote at the Annual Meeting. Holders of Voting Shares are entitled to cast one vote for each share of common stock, Series A-1 Preferred Stock, and Series B Preferred Stock held by them on the Record Date. At the Record Date, a total of [47,755,444] Voting Shares were outstanding and entitled to vote at the Annual Meeting, consisting of 4,203,576 shares of Series A-1 Preferred Stock, 356,713 shares of Series B Preferred Stock, and [43,195,155] shares of common stock.

What are the recommendations of the Board?

Overstock’s Board unanimously recommends votes:

“FOR” the election of each of the nominated directors named in this Proxy Statement (see Proposal 1);

“FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (see Proposal 2)2024;

The approval, on an advisory (non-binding) basis, of the compensation paid by the Company to its named executive officers (the “Say on Pay Vote”); “FOR” the Series A-1 Preferred Proposal (see Proposal 3);

“FOR” the Series B Preferred Proposal (see Proposal 4); and

“FOR” theThe approval of one or more adjournmentsan amendment (the “Declassification Amendment”) to the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Current Charter”), to declassify the Company’s Board of Directors;

The approval of an amendment to the Company’s Amended and Restated 2005 Equity Incentive Plan (the “2005 Plan”) to increase the per participant limit on the number of performance shares that may be granted in each calendar year to 250,000; and The approval of the Annual Meeting, if necessary or appropriate,grant of a performance-based stock option to solicit additional proxies if there are insufficient votesMarcus A. Lemonis, the Company’s Executive Chairman (the “Executive Chairman Performance Award”). Who can vote at the timeAnnual Meeting? Stockholders of record who owned shares of our stock at the close of business on the Record Date may virtually attend and vote at the Annual Meeting. Holders of our stock are entitled to cast one vote for each share of stock held by them on the Record Date. At the Record Date, a total of [45,734,750] shares of stock were outstanding and entitled to vote at the Annual Meeting. What are the recommendations of the Annual Meeting to approve either the Series A-1 Preferred Proposal or the Series B Preferred Proposal (see Proposal 5).Board? Beyond’s Board unanimously recommends votes: 1)

| “FOR” Joanna C. Burkey and “FOR” Barclay F. Corbus as directors (see Proposal 1); |

2)

| “FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (see Proposal 2); |

3)

| “FOR” the Say on Pay Vote (see Proposal 3); |

4)

| “FOR” the approval of the Declassification Amendment to declassify the Company’s Board (see Proposal 4); |

5)

| “FOR” the approval of an amendment to the Company’s 2005 Plan to increase the per participant limit on the number of performance shares that may be granted in each calendar year to 250,000 (see Proposal 5); and |

6)

| “FOR” the approval of the Executive Chairman Performance Award (see Proposal 6). |

What is a quorum? The presence virtually or by proxy of the holders of a majority of Voting Sharesthe shares of our stock outstanding on the Record Date will be necessary to constitute a quorum for the Annual Meeting. With respect to the Series A-1 Preferred Proposal (Proposal 3) and the Series B Preferred Proposal (Proposal 4), a quorum will also require a majority of the outstanding shares of Series A-1 Preferred Stock and a majority of the outstanding shares of Series B Preferred Stock. In addition, the presence of holders of a | | | | | | 20222024 Proxy Statement | 1 3

|

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters |

majority of the outstandingWe will count shares of Series A-1 Preferred Stock will be required for the Series A-1 Proposal (Proposal 3) and the presence of holders of a majority of the outstanding shares of Series B Preferred Stock will be required for the Series B Proposal (Proposal 4). Voting Sharesstock represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee that are represented at the meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as present and entitled to vote for purposes of determining the presence of a quorum. The inspector of election will tabulate the proxies and votes cast prior to the meeting and at the meeting to determine whether a quorum is present.

How do I vote? You may submit your proxy to have your shares voted via the internet, by telephone, or virtually at the Annual Meeting. If you received printed proxy materials, you also have the option of submitting your proxy card by mail. In addition, you can virtually attend the meeting and vote by following the instructions available on the virtual meeting website. The designated proxies will vote according to your instructions; however, if you are a registered stockholder and you return an executed proxy card without specific instructions on how to vote, the proxies will vote: “FOR” the election of each of the nominated directors named in Proposal 1;

“FOR” the ratification of KPMG LLP as our independent registered public accounting firm in Proposal 2;

“FOR” the approval of the Series A-1 Preferred Proposal as set forth in Proposal 3;

“FOR” the approval of the Series B Preferred Proposal as set forth in Proposal 4; and

“FOR” the approval of one or more adjournments of the Annual Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Annual Meeting to approve either the Series A-1 Preferred Proposal in Proposal 4 or the Series B Preferred Proposal in Proposal 5.

1)

| “FOR” Joanna C. Burkey and “FOR” Barclay F. Corbus as directors (see Proposal 1); |

2)

| “FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (see Proposal 2); |

3)

| “FOR” the Say on Pay Vote (see Proposal 3); |

4)

| “FOR” the approval of the Declassification Amendment to declassify the Company’s Board (see Proposal 4); |

5)

| “FOR” the approval of an amendment to the Company’s 2005 Plan to increase the per participant limit on the number of performance shares that may be granted in each calendar year to 250,000 (see Proposal 5); and |

6)

| “FOR” the approval of the Executive Chairman Performance Award (see Proposal 6). |

If you beneficially own your shares or are a “street name” stockholder and you do not return instructions on how to vote to your broker, the proxies will not vote your shares will not be votedon any of the Proposals except on Proposals 2 and 5.for Proposal 2. The voting of shares held by “street name” stockholders is further discussed below. Additionally, in order to vote at the meeting, you will need to obtain a signed legal proxy from the broker or nominee that holds your shares, because the broker or nominee is the legal, registered owner of the shares. If you have the broker’s proxy, you may vote by ballot virtually at the meeting. If you hold Voting Sharesshares of our stock in a retirement or savings plan or other similar plan, you may submit your vote via the internet or by telephone or by means of the direction on the proxy card. The trustee or administrator of the plan will vote according to your directions and the rules of the plan. How can I attend the meeting with the ability to ask a question and/or vote? The Annual Meeting will be a completely virtual meeting of stockholders, which we will be conductedconduct exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder(i) your shares of the CompanyCompany’s stock are registered directly in your name with our transfer agent, Computershare, as of the close of business on the Record Date (“Registered Holder”), or (ii) if you hold a valid legal proxy for the Annual Meeting if you are a beneficial holder and hold your shares through an intermediary, such as a bank or broker (“Beneficial Holder”). No We are not holding a physical meeting. We will begin the online meeting will be held. promptly at 12:00 p.m. Mountain Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined below. As a Registered Holder, you will be able to attend the Annual Meeting online, review the list of registered stockholders entitled to vote at the meeting, ask a question, and vote by visitingwww.meetnow.global/MDDV5FJ https://meetnow.global/M7X9UAS and following the instructions on your notice, proxy card, or on the instructions that accompanied your proxy materials. 4 | 2024 Proxy Statement | | | | | | |

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters |

If you are a Beneficial Holder and want to attend the Annual Meeting online by webcast (with the ability to ask a question and/or vote, if you choose to do so) you have two options: 1)

(1)

| Registration in Advance of the Annual Meeting |

| Submit proof of your proxy power (“Legal Proxy”) from your broker, bank, or bankother nominee reflecting your Overstock.comBeyond holdings along with your name and email address to Computershare. |

| RequestsYou must label requests for registration as set forth in (1) above must be labeled as “Legal Proxy” and be receivedwe must receive them no later than 3:00 p.m. Mountain Time on May 5, 2022.15, 2024. You will receive a confirmation of your registration by email after we receive your registration materials. |

2 | 2022 Proxy Statement

| | | | | | |

TABLE OF CONTENTS

Questions and Answers about the Annual Meeting and Procedural Matters

|

| RequestsYou should direct requests for registration should be directed to us at the following: |

| By email: Forward the email from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to legalproxy@computershare.com. |

By mail: | | | Computershare

Overstock.comBeyond Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001 |

2)

(2)

| Register at the Annual Meeting |

| Beneficial Holder Access to Virtual Meetings 2022 Proxy Season |

| For the 2022 proxy season, an industry solution has been agreed upon to allow Beneficial Holders tocan also register online at the Annual Meeting to attend, ask questions, and vote. We expect that the vast majority of Beneficial Holders will be able to fully participate using the control number received with their voting instruction form. Please note, however, that we provide this option is intended to be provided as a convenience to Beneficial Holders only, and there iswe make no guarantee this option will be available for every type of Beneficial Holder voting control number. The inability to provide this option to any or all Beneficial Holders shall in no way impact the validity of the Annual Meeting. Beneficial Holders may choose the Register in Advance of the Annual Meeting option above, if they prefer to use the traditional, paper-based option.option for registering for the Annual Meeting. |

| In any event, pleasePlease go towww.meetnow.global/MDDV5FJ https://meetnow.global/M7X9UAS for more information on the available options and registration instructions.

|

| The online meeting will begin promptly at 1:00 p.m. Mountain Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this Proxy Statement. |

Do I need to register to attend the meeting virtually? Registration in advance is only required if you are a Beneficial Holder, as set forth above. How can I vote online at the meeting? If you are a Registered Holder, follow the instructions on the notice, email, or proxy card that you received to access the meeting. If you are a Beneficial Holder, please see the registration options set forth in numbers (1) and (2) above. Online voting will be available during the meeting. To ensure that your vote is recorded promptly, please submit a proxy as soon as possible, even if you plan to virtually attend the meeting. Why are you holding a virtual meeting instead of a physical meeting? We are pleased to embrace the latest technology to providewhich allows for expanded access and improved communication for our stockholders and the Company. We believe that hosting a virtual meeting will enable more of our stockholders to attend and participate in the meeting since our stockholders can participate from any location around the world with internet access. We also believe holding a virtual meeting this year will help safeguard the health of all meeting participants in view of the concerns regarding the ongoing coronavirus pandemic. | | | | | | 2024 Proxy Statement | 5 |

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters |

What if I have trouble accessing the Annual Meeting virtually? The virtual meeting platform is fully supported across browsers (Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fiand reliable internet connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it, or you may call 1-888-724-2416.(888) 724-2416. What happens if a nominee is unable to stand for election? | | | | | | 2022 Proxy Statement | 3

|

TABLE OF CONTENTS

Questions and Answers aboutIf any director nominee should be unable to serve, or for good cause will not serve, the Annual Meeting and Procedural Matters

|

The Nominating and Corporate Governance Committee of the Board of Directors may select a substitute nominee.nominee or the Board may elect to reduce its size. In that case, if you have submitted your proxy via the internet or by telephone or completed and returned your proxy card or voting instruction card, the proxy holders will have the discretion to vote your shares for the substitute nominee. They cannot vote for more than the three Class IItwo nominees. We have no reason to believe that any of the nominees will be unable to serve if elected.

Can I submit a proxy via the internet or by telephone? You may submit your proxy to have your shares voted at the Annual Meeting via the internet or by telephone by following the instructions contained in the notice of internet availability of proxy materials. If you received a printed set of the proxy materials, you may submit your proxy via the internet or by telephone by following the instructions contained on the proxy card that accompanied the printed materials. If you are a registered stockholder,Registered Holder, the deadline for submitting your proxy by telephone or via the internet is 11:59 p.m. Eastern Time on May 11, 2022.20, 2024. If you are a participant in the OverstockCompany 401(k) plan, the deadline for submitting your voting directions by telephone or via the internet is 11:59 p.m. Eastern Time on May 9, 2022.16, 2024. Can I change my vote or revoke my proxy? SubjectRegistered Stockholders:

Prior to the Annual Meeting and subject to the deadlines set forth in the paragraph above, you may change your vote at any time before such deadline by re-submitting your proxy via the internet or by telephone or by virtually attending the Annual Meeting and voting at the Annual Meeting by filling out an online ballot. If you have delivered a proxy, you may revoke your proxy at any time before the proxies vote your shares are voted by filing with our Corporate Secretary a written notice of revocation at our Company headquarters at the address shown on the first page of this Proxy Statement. The revocation must be received prior to the time the proxies vote your shares are voted. Atshares. During the meeting,Annual Meeting, you also may revoke your proxy by voting via online ballotballot. You must be logged in as a “Stockholder” and not as a “Guest” to vote at the virtual stockholder meeting. Yourmeeting, and your virtual attendance at the meeting alone will not by itself revoke your proxy. Beneficial Stockholders: If your shares are held in “street name” or you are a participant in the OverstockCompany 401(k) plan, please contact your broker, nominee, trustee, or administrator to determine whether and how you will be able to revoke or change your vote. Why did I receive a notice of internet availability of proxy materials instead of a full set of the proxy materials? To be environmentally conscious, and in accordance with the rules of the U.S. Securities and Exchange Commission (the “SEC”) which allow companies to furnish their proxy materials via the internet, we sent some of our stockholders a notice of internet availability of proxy materials for this year’s Annual Meeting of stockholders. OtherMeeting. We sent some stockholders were instead sent paper copies of the proxy materials accessible via the internet. InstructionsYou can find instructions on how to access the proxy materials via the internet or to request a paper copy can be found in the notice of internet availability of proxy materials. In addition, stockholders may request future proxy materials be sent to you in printed form by mail or electronically by e-mail on an ongoing basis by following the instructions on the notice of internet availability mailed to you. A stockholder’s election to receive proxy materials by mail or e-mail will remain in effect until the stockholder terminates it. 6 | 2024 Proxy Statement | | | | | | |

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters |

Can I vote my shares by filling out and returning the notice of internet availability of proxy materials? No, but the notice of internet availability of proxy materials is not a form for voting, but provides instructions on how to vote your shares. What is the voting requirement to approve each of the proposals? Assuming a quorum is present, the matters to come before the Annual Meeting that are listed in the Notice of Annual Meeting of Stockholders require the votes described below to be approved. Proposal 1—Election of Directors—Directors—Directors to our Board are elected by a plurality of the votes cast by the holders of Voting Shares,shares of stock, meaning that the nominee(s)nominees for the applicable election receiving the highest number of Voting Sharesshares voted “for” their election will be elected as members of the Board of Directors. This year, such nominees would be elected as Class II members of the Board of Directors.Board. Our director resignation policy requires that if any nominee for director fails to receive a greater number of “for” votes than “withheld” votes in an uncontested election (such as at the Annual Meeting), such person 4 | 2022 Proxy Statement

| | | | | | |

TABLE OF CONTENTS

Questions and Answers about the Annual Meeting and Procedural Matters

|

must tender his or her resignation to the Chairpersonchairperson of the Board within five business days following certification of the vote. See “The Board—Director Resignation Policy.” With respect to the election of directors, you may vote “for” or “withhold” authority to vote for any nominee for election. If you “withhold” authority to vote with respect to any director nominee, your vote will have no effect on the election of such nominee. Broker non-votes also will have no effect on the election of directors. There is no cumulative voting in the election of directors.

| • | Votes Withheld. With respect to the election of directors, you may vote “for” or “withhold” authority to vote for any nominee for election. If you “withhold” authority to vote with respect to any director nominee, your vote will have no effect on the election of such nominee. |

| • | Broker Non-Votes. Broker non-votes also will have no effect on the election of directors. |

Proposal 2—Ratification of our Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm—thefirm—The affirmative vote of the holders of a majority of the shares of Voting Sharesstock present or represented by proxy and voting on the matter (which shares voting affirmatively also constitute at least a majority of the required quorum) is required to approve this proposal. You may vote “for,” “against,” or “abstain” on this proposal. | • | Abstentions. Abstentions will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of our stock present or represented by proxy and voting at the meeting. However, abstentions could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

| • | Broker Non-Votes. We do not expect any broker non-votes on this proposal. However, we understand that certain brokers have elected not to vote even on routine matters. See “What are broker non-votes?” below. If a broker or other nominee has made this decision and they do not receive voting instructions, a broker non-vote will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of our stock present or represented by proxy and voting at the meeting. However, broker non-votes could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

Proposal 3—Say on Pay Vote—The affirmative vote of the holders of a majority of the shares of stock present virtually or represented by proxy and voting on the matter (which shares voting affirmatively also constitute at least a majority of the required quorum) is required to approve this proposal. You may vote “for,” “against,” or “abstain” on this proposal. Abstentions will have no effect on the determination of whether this proposal has received the vote of a majority of Voting Shares present virtually or represented by proxy and voting at the meeting. However, abstentions could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. | • | Abstentions. Abstentions will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of stock present or represented by proxy and voting at the meeting. However, abstentions could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

| • | Broker Non-Votes. Broker non-votes will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of stock present or represented by proxy and voting at the meeting. However, broker non-votes could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

Proposal 3—Series A-1 Preferred Proposal – Approval of amendment4—Amendment to the Amended and Restated CertificateCompany’s Current Charter to declassify the Board of Designation of our Series A-1 Preferred Stock to make Series A-1 Preferred Stock automatically convert into common stock—theDirectors—The affirmative votesvote of the holders of a majority of the issued and outstanding shares of (i) Voting Shares, voting together as a class, (ii) Series A-1 Preferred Stock, voting as a separate series, and (iii) Series A-1 Preferred Stock and Series B Preferred Stock, voting together as a class,the Company’s common stock is required to approve this proposal. You may vote “for,” “against,” or “abstain” on this proposal. Abstentions and broker non-votes will have the effect of votes “against” this proposal. Proposal 4—Series B Preferred Proposal – Approval of amendment to the Amended and Restated Certificate of Designation of our Series B Preferred Stock to make Series B Preferred Stock automatically convert into common stock—the affirmative votes of the holders of a majority of the issued and outstanding shares of (i) Voting Shares, voting together as a class, (ii) Series B Preferred Stock, voting as a separate series, and (iii) Series A-1 Preferred Stock and Series B Preferred Stock, voting together as a class, is required to approve this proposal. You may vote “for,” “against,” or “abstain” on this proposal.| • | Abstentions. Abstentions and broker non-votes will have the effect of votes “against” this proposal. Proposal 5—Adjournment Proposal – Approval of one or more adjournments of the Annual Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Annual Meeting to approve either the Series A-1 Preferred Proposal or the Series B Preferred Proposal—the affirmative vote of the holders of a majority of the shares of Voting Shares present virtually or represented by proxy. You may vote “for,” “against,” or “abstain” on this proposal. Abstentions will have the effect of a vote “against” the proposal.

What happens if both the Series A-1 Preferred Proposal and the Series B Preferred Proposal are approved?

If both the Series A-1 Preferred Proposal and the Series B Preferred Proposal are approved by our stockholders, we will file the amendments to the amended and restated certificates of designation for both the Series A-1 Preferred Stock and the Series B Preferred Stock, in the forms attached to this Proxy Statement as Appendix A and Appendix B, respectively, with the Delaware Secretary of State.

Upon filing of these amendments, all outstanding shares of Series A-1 Preferred Stock will automatically convert into 0.90 of a share of common stock, and all outstanding shares of Series B Preferred Stock will automatically convert into 0.90 of a share of common stock, in each case without any further action by the Company or our stockholders.

What happens if only one of the Series A-1 Preferred Proposal and the Series B Preferred Proposal is approved?

The Series A-1 Preferred Proposal and the Series B Preferred Proposal are each conditioned on approval of the other proposal. If our stockholders approve one such proposal but not the other, we will not file the amendments to the amended and restated certificates of designation for either the Series A-1 Preferred Stock or Series B Preferred Stock. In that event, the preferred stock will not be converted into shares of our common stock, and holders of our Series A-1 Preferred Stock and Series B Preferred Stock will continue to hold those shares of preferred stock.

|

| • | Broker Non-Votes. Broker non-votes will have the effect of votes “against” this proposal. |

| | | | | | 20222024 Proxy Statement | 5 7

|

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters |

How did the Board determine the fairness of the conversion terms in the Series A-1 Preferred Proposal and the Series B Preferred Proposal5—Amendment to the Company’s stockholders?

In reaching its conclusion that the Series A-1 Preferred ProposalAmended and the Series B Preferred Proposal is in our best interests and the best interests of all our stockholders, the Board consulted our management, legal counsel, and financial advisors regarding the termsRestated 2005 Equity Incentive Plan—The affirmative vote of the proposed amendment to the Series A-1 Certificateholders of Designation and the proposed amendment to the Series B Certificate of Designation and considered a number of factors, including the following material factors:

The limited trading volume and limited liquiditymajority of the Series A-1 Preferred Stock;

Althoughstock present or represented by proxy and voting on the Series A-1 Preferred Stock is intended to have similarmatter (which shares voting and dividend rights and rights upon liquidation as our common stock, the trading priceaffirmatively also constitute at least a majority of the Series A-1 Preferred Stock has been, andrequired quorum) is required to approve this proposal. You may be invote “for,” “against,” or “abstain” on this proposal.

| • | Abstentions. Abstentions will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of our stock present or represented by proxy and voting at the meeting. However, abstentions could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

| • | Broker Non-Votes. Broker non-votes will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of our stock present or represented by proxy and voting at the meeting. However, broker non-votes could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

Proposal 6—Approval of the future, substantially lower thanExecutive Chairman Performance Award—The affirmative vote of the trading price of our common stock; The Company’s dispositionholders of a controlling interest in its blockchain businesses and corresponding emphasis on retail;

The limited quantity and liquiditymajority of the Series B Preferred Stock;stock present or represented by proxy and

Although voting on the Series B Preferred Stock is intended to have similarmatter (which shares voting and dividend rights and rights upon liquidation as our common stock, the trading priceaffirmatively also constitute at least a majority of the Series B Preferred Stock has been at times, andrequired quorum) is required to approve this proposal. You may be in the future, substantially lower than the trading price of our common stock.

In addition, in reaching its conclusion that the Series A-1 Preferred Proposal and the Series B Preferred Proposal is in the Company’s interests, the Board considered the financial analyses reviewed by Houlihan Lokey Capital, Inc. (“Houlihan Lokey”) with the Board, as well as the opinion of Houlihan Lokey rendered to the Boardvote “for,” “against,” or “abstain” on March 3, 2022, as to the fairness, from a financial point of view, to the Company of the number of shares of common stock into which each share of Series A-1 Preferred Stock would be converted pursuant to the proposed amendment to the Series A-1 Certificate of Designation and the number of shares of common stock into which each share of Series B Preferred Stock would be converted pursuant to the proposed amendment to the Series B Certificate of Designation.this proposal.

| • | Abstentions. Abstentions will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of our stock present or represented by proxy and voting at the meeting. However, abstentions could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

| • | Broker Non-Votes. Broker non-votes will have no effect on the determination of whether this proposal has received the vote of a majority of the shares of our stock present or represented by proxy and voting at the meeting. However, broker non-votes could prevent the approval of this proposal if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the required quorum. |

What are broker non-votes? Stockholders who hold their shares through a broker or other nominee (in “street name”) must provide specific instructions to their brokers or other nominee as to how to vote their shares, in the manner prescribed by their broker or other nominee. In the absence of instructions, and in accordance with applicable stock exchange rules, brokers and nominees typically have the discretion to vote such shares on routine matters, namelyfor example the ratification of the appointment of auditors, but not on non-routine matters. If a broker or nominee has not received voting instructions from an account holder and does not have discretionary authority to vote shares on a particular item because it is a non-routine matter, a “broker non-vote” occurs. However, we understand that certain brokers have elected not to vote even on routine matters, such as the ratification of the appointment of auditors, without your voting instructions. If your broker or other nominee has made this decision, and you do not provide voting instructions, your vote will not be cast for any of the Proposals. Accordingly, we urge you to direct your broker or other nominee how to vote by returning your voting materials as instructed or by obtaining a proxy from your broker or other nominee in order to vote your shares electronically at the Annual Meeting. Which proposals are considered “routine” or “non-routine”? Proposal 2 (the proposed ratification of our independent registered public accounting firm) and Proposal 5 (the Adjournment Proposal) areis considered a routine matters.matter. A broker or other nominee may generally vote in their discretion on routine matters, and therefore no broker non-votes are expected in connection with Proposals 2 and 5.Proposal 2. Proposals 1, 3, 4, 5, and 46 are considered non-routine and, therefore, brokers cannot vote shares with respect to such proposals with respect to shares that the broker does not receive instructions. How many shares of Voting Sharesstock are outstanding and entitled to vote at the meeting? At the Record Date, a total of [47,755,444] Voting Shares[45,734,750] shares of stock were outstanding and entitled to vote at the meeting, consisting of 4,203,576 shares of Series A-1 Preferred Stock, 356,713 shares of Series B Preferred Stock, and [43,195,155] shares of common stock. Are any shares entitled to a class vote on any of the proposals to be considered at the meeting?

No shares of any class are entitled to a class vote on Proposals 1, 2, and 5. The Series A-1 Preferred Stock is entitled to a separate series vote on Proposal 3. The Series B Preferred Stock is entitled to a separate series vote on Proposal 4. Inmeeting.

6 8 | 2022 2024 Proxy Statement

| | | | | | |

TABLE OF CONTENTS Questions and Answers about the Annual Meeting and Procedural Matters |

addition, the Series A-1 Preferred Stock and Series B Preferred Stock are entitled to a vote as a single class on each of Proposals 3 and 4.

How many votes are required to approve other matters that may come before the stockholders at the meeting? TheWe require the affirmative vote of the holders of a majority of the Voting Sharesshares of stock represented and voting at the meeting (which shares voting affirmatively also constitute at least a majority of the required quorum) will be required to approve any other matters that may properly come before the meeting, unless a different vote is required by law, by our Certificate of Incorporation, by our bylaws, or applicable law.

Is my vote kept confidential? Proxies,We keep confidential and do not disclose proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Where do I find the voting results of the meeting? We willintend to announce preliminary voting results at the meeting. We will also file a Form 8-K with the SEC reporting the results within four business days after the date of the meeting. You can get a copy of that Form 8-K by e-mailing Overstock Investor Relations at ir@overstock.com ir@beyond.com or through the EDGAR system at https://www.sec.gov. You can also get a copy from our website at http:https://investors.overstock.com/financial-information/sec-filings.investors.beyond.com/financials/sec-filings. Who pays for the proxy solicitation process? TheWe make the solicitation is made on behalf of the Company and its Board of Directors.the Board. We will pay the costs of soliciting proxies, including the cost of preparing, posting, and mailing proxy materials. In addition to soliciting stockholders by mail, we will request brokers, banks, and other nominees to solicit their customers who hold shares of our common stock Series A-1 Preferred Stock, or Series B Preferred Stock in street name. We may reimburse such brokers, banks, and nominees for their reasonable out-of-pocket expenses. We may also use the services of our officers, directors, and employees to solicit proxies, personally or by telephone, mail, facsimile, or email, without additional compensation other than reimbursement for reasonable out-of-pocket expenses. We intend to use the services of Georgeson Inc.LLC in connection with the meeting, including to assist in the distribution of proxy materials and the solicitation of proxies from individual stockholders as well as brokerage firms, fiduciaries, custodians, institutional investors, and other similar organizations representing beneficial owners of shares for the meeting. We anticipate that the costs of such services will be approximately $11,000$64,000 plus reimbursement for reasonable out-of-pocket expenses.

How can I get an additional copy of the proxy materials? If you would like an additional copy of this Proxy Statement or our Annual Report on2023 Form 10-K, for the fiscal year ended December 31, 2021 (the “2021 Form 10-K”), these documents are available in digital form for download or review at http:https://www.overstock.com/proxyinvestors.beyond.com/financials/annual-reports. Alternatively, we will promptly send a copy to you at no charge upon request by mail to Overstock.com,Beyond, Inc., Attention: Investor Relations, 799 W. Coliseum Way, Midvale, Utah 84047, or by e-mailing Overstock Investor Relations at ir@overstock.com.ir@beyond.com. Who can help answer my questions? If you have questions about voting or the proposals described in this Proxy Statement, please call Georgeson Inc.,LLC, our proxy solicitor, toll-free at (866) 432-2791. Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 12, 2022.

The Notice of Annual Meeting, Proxy Statement, and Annual Report on Form 10-K for the fiscal year

ended December 31, 2021 are available at http://www.overstock.com/proxy.

Whether or not you plan to virtually attend the meeting, please submit your proxy via the internet, telephone, or by

completing, signing, dating, and returning your Proxy Card in the enclosed prepaid business reply envelope.357-5237.

| | | | | | 20222024 Proxy Statement | 7 9

|

TABLE OF CONTENTS Proposals to be Voted on:

Proposal 1—Election of Directors

The nominees for election this year are Joanna C. Burkey and Barclay F. Corbus. At the Annual Meeting, our stockholders will cast their votes for each of Ms. Burkey and Mr. Corbus to be elected (1) if the Declassification Amendment to our Current Charter is approved (as discussed in further detail in Proposal 4), as a director with a term to expire at the 2025 annual meeting of stockholders and until such person’s respective successor has been duly elected and qualified or until such person’s earlier death, resignation, or removal, and (2) if the Declassification Amendment is not approved, as a Class II directors, each forI director with a three-year term ending in 2025, are Joseph J. Tabacco, Jr., Dr. Robert J. Shapiro,to expire at the 2027 annual meeting of stockholders and Barbara H. Messing.until such person’s respective successor has been duly elected and qualified or until such person’s earlier death, resignation, or removal. Age: 48

Director since:

March 2023

Committee

Memberships: Audit,

Compensation | | | Mr. Joseph J. Tabacco, Jr.Joanna C. Burkey

Ms. Joanna C. Burkey has served as a director of OverstockBeyond since June 2007. For more thanMarch 2023. Ms. Burkey most recently served as the last five years Chief Information Security Officer for HP Inc. (NYSE: HPQ) from April 2020 until December 2023. In this role, she and her team had responsibility for HP’s global cybersecurity operations, strategy/architecture and business alignment. Prior to that, she served as the Global Head, Cyber Defense and Deputy Chief Cybersecurity Officer of Siemens AG from September 2018 to April 2020. Ms. Burkey is also currently a member of the board of directors of ReliabilityFirst Corporation, a privately held entity tasked with helping to ensure the reliability of the North American Bulk-Power System, and serves as senior advisor to multiple privately held cybersecurity enterprises, including TAG Cyber and Cyberhaven. Ms. Burkey holds a B.S. in Computer Science from Angelo State University. The specific experience, qualifications, attributes, and skills that led the Board to conclude that Ms. Burkey should serve as a director considering our business and structure were Ms. Burkey’s 25-year career in cybersecurity across a broad variety of roles, including software engineering, product strategy and security research.

As a result of the above and other experiences, Ms. Burkey possesses particular knowledge, skill and/or experience in a number of other areas that strengthen the Board’s collective knowledge, experience, and capabilities, including but not limited to senior leadership, finance or accounting, legal or risk management, regulatory or government, technology, information/cyber security, global or international business, strategic planning, ESG understanding, and business transformation. |

10 | 2024 Proxy Statement | | | | | | |

TABLE OF CONTENTS Age: 57

Director since: 2007

Committee

Memberships: Nominating and Corporate Governance, Compensation (Chairman) | | | Barclay F. Corbus

Mr. Tabacco was the founding partner andBarclay F. Corbus has served as managing partnera director of Beyond since March 2007. He also served on the San Francisco officeboard of Berman Tabacco. A 1974 honors graduatedirectors of George Washington University School of Law,tZERO, a privately held blockchain technology company, and Medici Ventures, Inc. (“Medici Ventures”), our former wholly-owned subsidiary specializing in blockchain technologies, until April 2021. Mr. Tabacco litigates antitrust, securities fraud, commercial high tech, and intellectual property matters. Since entering private practice in the early 1980s, Mr. TabaccoCorbus has served as trial or lead counselSenior Vice President of Clean Energy Fuels Corp. (NASDAQ:CLNE), a provider of renewable fuel for vehicles, with responsibility for strategic development and renewable fuel project development, since September 2007. He served as Co-CEO of WR Hambrecht + Co., an investment banking firm, from July 2004 to September 2007, and prior to that date served in numerous antitrust and securities cases.other executive positions with WR Hambrecht + Co. Prior to 1981,joining WR Hambrecht + Co. in March 1999, Mr. Tabacco served as senior trial attorney forCorbus was in the U.S. Department of Justice, Antitrust Division.investment banking group at Donaldson, Lufkin and Jenrette. Mr. Corbus graduated from Dartmouth College with a B.A. in Government and has a M.B.A. in Finance from Columbia Business School. The specific experience, qualifications, attributes, and skills that led the Board to conclude that Mr. TabaccoCorbus should serve as a director considering our business and structure were his substantial experience in finance, management, and leadership in securities and shareholder matters, his experience and leadership in litigation,strategic planning, and his experience managinganalyzing and evaluating corporate business plans, capital structures and needs, and debt, equity and hybrid financing alternatives resulting from his law firm. |

| | | Dr. Robert J. Shapiro has served asAs a director of Overstock since February 2020. Dr. Shapiro previously served as a memberresult of the boardabove and other experiences, Mr. Corbus possesses particular knowledge, skill and/or experience in a number of directors of Medici Ventures, our former wholly-owned subsidiary, until April 2021other areas that strengthen the Board’s collective knowledge, experience, and previously served on the board of directors of MLG, a Medici Ventures portfolio company. Dr. Shapiro is the chairmancapabilities, including but not limited to senior leadership, finance or accounting, global or international business, strategic planning, environmental sustainability, ESG understanding, and founder of Sonecon, LLC, a private consultancy firm he founded in 2001 that advises the U.S. government, U.S. and foreign businesses, and non-profit organizations on economic matters. He has advised three U.S. presidents, numerous U.S. senators and representatives, members of the Clinton, Bush and Obama cabinets, foreign government officials, executives at Fortune 100 companies, and non-profit organizations. Dr. Shapiro is also a senior fellow of the Georgetown University Center for Business and Public Policy, director of the NDN Center on Globalization, and a member of the advisory boards of Cote Capital and Civil Rights Defenders. From 1997 to 2001, he was U.S. Under Secretary of Commerce for Economic Affairs. Prior to that, he was co-founder and vice president of the Progressive Policy Institute and, before that, the legislative director and economic counsel to Senator Daniel P. Moynihan. Dr. Shapiro also served as the principal economic advisor to Bill Clinton in his 1991-92 campaign, a senior economic advisor to Hilary Rodham Clinton in 2016, and advised the presidential campaigns of Joseph Biden, Barack Obama, John Kerry, and Al Gore. He has been a fellow of Harvard University, the Brookings Institution, the National Bureau of Economic Research, and the Fugitsu Institute. He holds a Ph.D. and M.A. from Harvard University, a M.Sc. from the London School of Economics and Political Science, and an A.B. from the University of Chicago. The specific experience, qualifications, attributes, and skills that led the Board to conclude that Dr. Shapiro should serve as a director considering our business and structure were his experience with foreign businesses, governments, and economics.transformation.

|

8 | 2022 Proxy Statement

| | | | | | |

TABLE OF CONTENTS

| | | Ms. Barbara H. Messing has served as a director of Overstock since August 2020. Ms. Messing is the Chief Marketing and Employee Experience Officer for Roblox (NYSE:RBLX). Prior to Roblox, Ms. Messing held the role of Senior Vice President, Chief Marketing Officer (“CMO”) for Walmart Inc. from 2018 to 2019. Prior to joining Walmart, she served as the Senior Vice President, CMO, of TripAdvisor, Inc. where she worked from 2011 to 2018. Prior to that she served in several management positions at Hotwire.com between 2002 and 2011, including Vice President of Customer Experience, and Vice President and General Manager, Travel Ticker. Ms. Messing is currently also a director on the board of Vacasa, Inc. (NASDAQ:VCSA). She has previously served on the board of directors of Diamond Resorts from 2020-2021, Mashable, Inc. from 2014-2017 and of XO Group, Inc. from 2014-2018. Ms. Messing received her Bachelor of Arts degree from Northwestern University and her Juris Doctorate from Stanford Law School. The specific experience, qualifications, attributes, and skills that led the Board to conclude that Ms. Messing should serve as a director considering our business and structure were her extensive marketing and on-line retail experience, including her roles of Chief Marketing and Employee Experience Officer at Roblox, CMO with Walmart, and CMO with TripAdvisor, and her experience with Hotwire.com and Travel Ticker.

|

Each of Joseph J. Tabacco, Jr., Dr. Robert J. Shapiro,Joanna C. Burkey and Barbara H. MessingBarclay F. Corbus has consented to serve as a three-year term.director if elected at the Annual Meeting. For additional information about each nominee, see “The Board—Information Regarding the Director NomineeNominees and Other Directors.” Vote Required The plurality of the votes cast by the holders of shares of stock is required to elect each nominee. Recommendation of the Board of Directors The Board of Directors unanimously recommends athat the stockholders vote “FOR” each nominee. | | | | | | 20222024 Proxy Statement | 9 11

|

TABLE OF CONTENTS Proposal 2—Ratification of Appointment of Independent Registered Public Accounting Firm

Proposed Ratification of Appointment of KPMG LLP The Audit Committee of the Board of Directors has appointed KPMG LLP as our independent registered public accounting firm to audit our financial statements for the fiscal year ending December 31, 20222024 and the effectiveness of our internal controlscontrol over financial reporting as of December 31, 2022.2024. KPMG LLP has served as our independent registered public accounting firm since December 2009. Although ratification of the Audit Committee’s selection of KPMG LLP is not required under our bylaws or other legal requirements, we are submitting the appointment of KPMG LLP to the stockholders as a matter of good corporate practice. If the stockholders do not ratify the appointment of KPMG LLP, the Audit Committee will reconsider whether to retain KPMG LLP.LLP, and will consider this fact when it appoints the independent registered public accounting firm for the fiscal year ending December 31, 2025. Even if the stockholders ratify the selection of KPMG LLP, the Audit Committee may appoint a different independent registered public accounting firm or replace KPMG LLP with a different independent registered public accounting firm at any time if the Audit Committee determines that it is in the best interests of the Company and theits stockholders to do so. Representatives of KPMG LLP are expected to virtually attend the Annual Meeting to respond to appropriate questions and will have an opportunity to make a statement if they so desire. Audit Fees KPMG LLP was engaged as our independent registered public accounting firm to audit our financial statements for the years ended December 31, 20212023 and 2020,2022, to audit the effectiveness of our internal control over financial reporting as of December 31, 20212023 and 2020,2022, to review our 20212023 and 20202022 interim financial statements, to perform services in connection with our registration statements, and SEC comment letter responses, to perform audits of certain subsidiaries in connection with statutory or regulatory filings, and to perform certain accounting consultation services. The aggregate audit fees KPMG LLP billed us for professional services were $2,512,508$2,058,046 in 20212023 and $2,909,146$2,141,855 in 2020.2022. All audit fees and other fees were pre-approved by the Audit Committee. Audit-Related Fees KPMG LLP billed us $44,164$54,306 in 20212023 in connection with consent fees for SEC filings and $32,404$15,000 in 20202022 in connection with consent fees for the audits of our 401(k) employee benefit plan and other accounting consultation services.plan. Tax Fees KPMG LLP billed us $72,636$57,376 in 20212023 and $40,802$50,918 in 20202022 for professional services rendered in connection with tax advice. All Other Fees KPMG LLP billed us $2,430$2,500 in 20212023 and $2,500 in 20202022 for a subscription to KPMG Accounting Research Online. Auditor Independence The Audit Committee has considered the role of KPMG LLP in providing us with the services described above and has concluded that those services were compatible with the independence of KPMG LLP from management and from the Company. 10 12 | 2022 2024 Proxy Statement

| | | | | | |

TABLE OF CONTENTS Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm General The Audit Committee has adopted an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which all services to be performed by the independent registered public accounting firm are required to be pre-approved. Under the Policy, proposed services either may be pre-approved by agreeing to a framework with descriptions of allowable services with the Audit Committee (“general pre-approval”), or require the specific pre-approval of the Audit Committee (“specific pre-approval”). Unless a type of service has received general pre-approval, it requires specific pre-approval by the Audit Committee if it is to be provided by the independent registered public accounting firm. The Policy describes the Audit, Audit-related, Tax, and All Other Services that are subject to the general pre-approval of the Audit Committee. The Audit Committee annually reviews and pre-approves the services that may be provided by the independent registered public accounting firm that are subject to general pre-approval. Under the Policy, the Audit Committee may delegate either type of pre-approval authority to its chairperson or any other member or members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next meeting. The Policy does not delegate the Audit Committee’s responsibilities to pre-approve services performed by the independent registered public accounting firm to management. Audit Services The annual audit services engagement scope and terms are subject to the general pre-approval of the Audit Committee. Audit services include the annual financial statement audit (including required interim reviews performed in accordance with applicable standards) and other procedures required to be performed by the independent registered public accounting firm to be able to form an opinion on our consolidated financial statements as well asand annual financial statement audits of certain subsidiaries in connection with statutory or regulatory filings. Audit services also include the attestation engagement for the independent registered public accounting firm’s audit of the effectiveness of internal control over financial reporting. The Policy provides that the Audit Committee will monitor the audit services engagement throughout the year and will also approve, if necessary, any changes in terms and conditions resulting from changes in audit scope or other items. The Policy provides for Audit Committee pre-approval of specific audit services outside the engagement scope. Audit-related Services Audit-related services are assurance and related services that are reasonably related to the performance of the audit or review of our financial statements or that are traditionally performed by the independent registered public accounting firm. Under the Policy, the Audit Committee grants general pre-approval for audit-related services. Tax Services Under the Policy, the Audit Committee may grant general pre-approval for specific tax compliance, planning and advice services to be provided by the independent registered public accounting firm, that the Audit Committee has reviewed and believes would not impair the independence of the independent registered public accounting firm, and that are consistent with the SEC’s rules on auditor independence. Tax services to be performed by our independent registered public accounting firm must be specifically approved by the Audit Committee. All Other Services Under the Policy, the Audit Committee may grant pre-approval for specific permissible non-audit services classified as All Other Services that it believes are routine and recurring services, would not impair the independence of the independent registered public accounting firm and are consistent with the SEC’s rules on auditor independence. Services permissible under applicable rules but not specifically approved in the Policy require further specific pre-approval by the Audit Committee. | | | | | | 20222024 Proxy Statement | 11 13

|

TABLE OF CONTENTS Procedures Under the Policy, each year the Chief Financial Officer and our independent registered public accounting firm jointly submit to the Audit Committee a schedule of audit, audit-related, tax, and other non-audit services that are subject to pre-approval. This schedule provides a description of each type of service that is subject to pre-approval and, where possible, provides projected fees (or a range of projected fees) for each service. The Audit Committee reviews and approves the types of services and reviews the projected fees for the next fiscal year. Any changes to the fee amounts listed in the schedule are subject to further specific approval of the Audit Committee. The Policy prohibits the independent registered public accounting firm from commencing any project not described in the schedule approved by the Audit Committee until specific approval has been given. Vote Required The affirmative vote of the holders of a majority of the shares of stock present or represented by proxy and voting on the matter (which shares voting affirmatively also constitute at least a majority of the required quorum) is required to approve this proposal. Recommendation of the Board of Directors The Audit Committee and the Board of Directors unanimously recommend that the stockholders vote “FOR” Proposal 2—Ratificationthe ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2022.2024. 12 14 | 2022 2024 Proxy Statement

| | | | | | |

TABLE OF CONTENTS Proposal 3— Series A-1 Preferred ProposalAdvisory Vote on the Compensation Paid by the Company to its Named Executive Officers (“Say on Pay Vote”)

Approval of an amendmentPursuant to the AmendedDodd-Frank Wall Street Reform and Restated CertificateConsumer Protection Act and Section 14A of Designationthe Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are asking our stockholders to approve, on an advisory (non-binding) basis, the compensation of our Digital Voting Series A-1 Preferred Stock to provide for the automatic conversion into common stock

General

The Board adopted resolutions declaring it advisable to amend the amended and restated certificate of designation for the Series A-1 Preferred Stock (the “Series A-1 Certificate of Designation”)named executive officers as set forth below and directing that the proposed amendment be submitted for consideration by Overstock’s stockholders at the Annual Meeting. The descriptiondisclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K (the “Named Executive Officers” or “NEOs”).

Our executive compensation is discussed in further detail below under the caption “Compensation Discussion and Analysis” which, together with the sections following the Compensation Discussion and Analysis, include information about the fiscal year 2023 compensation of our NEOs and a discussion of actions regarding executive compensation that were taken after December 31, 2023. We are asking our stockholders to indicate their support for the compensation of our NEOs, as described in this Proxy Statement. This proposal, commonly known as a “say on pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we ask our stockholders to vote “FOR” the following resolution at our Annual Meeting: RESOLVED, that the stockholders approve the compensation of the proposed amendmentCompany’s NEOs as disclosed in the Company’s Proxy Statement for the 2024 annual meeting of stockholders pursuant to the Series A-1 Certificate of Designation is qualified in its entirety by reference to, and should be read in conjunction with, the actual textcompensation disclosure rules of the amendment as set forth inSecurities and Exchange Commission (which includes the Certificate of Amendment attached as Appendix A to this Proxy Statement (the “Series A-1 Certificate of Amendment”)Compensation Discussion and Analysis, the compensation tables and related narrative discussion). The Series A-1 Certificate of DesignationSay on Pay Vote is proposed to be amended to provide that each share of Series A-1 Preferred Stockadvisory and, therefore, not binding on the Board or on the Company; however, the Compensation Committee will be automatically converted into 0.90 of a share of common stock, upon effectivenessconsider the outcome of the filingvote when considering future executive compensation arrangements. The last time a say on pay vote was held was at the annual meeting of the Series A-1 Certificate of Amendment with the Delaware Secretary of State. Purpose and Effect of the Series A-1 Preferred Proposal

We originally issued the Series A-1 Preferred Stockstockholders in 20192023, in connection with our initiatives to develop and advance blockchain technologies. The Series A-1 Preferred Stock was not to be listed on any national securities exchange or other trading market of any kind and was to be sold only on the alternative trading system (the “tZERO ATS”) run by tZERO ATS, LLC, a former indirect subsidiary of ours, through a brokerage account established with a broker-dealer that subscribes to and effects trading on the tZERO ATS. The tZERO ATS has limited trading volume and has produced limited liquidity for holders of the Series A-1 Preferred Stock. In addition, although the Series A-1 Preferred Stock is intended to have similar voting and dividend rights and rights upon liquidation as our common stock, the trading price of the Series A-1 Preferred Stock has been, and may be in the future, substantially lower than the trading pricewhich 93.8% of our common stock.

In early 2021, we entered into a Transaction Agreement with Pelion MV GP, L.L.C. (“Pelion”), and Pelion, Inc., as guarantor, pursuantstockholders voted to which our blockchain-focused wholly owned subsidiary, Medici Ventures, Inc., was converted into a partnership in which Pelion controls asapprove the general partner and the Company holds 99% of the limited partnership interests (non-voting). As a result of this transaction, our majority interest in our other blockchain-focused subsidiary, tZERO Group, Inc. (“tZERO”), became a minority interest. In deciding to pursue this transaction, the Company determined that the Medici Ventures businesses will be better served under the management of Pelion, a professional asset manager with technology expertise in early-stage companies, while also enablingcompensation paid by the Company to focusits NEOs. At the 2023 annual meeting, the “EVERY YEAR” selection received the highest number of votes from our stockholders as the recommended frequency of future say on its core retail business.pay votes. The Board expects to hold the next advisory say on pay vote at the annual meeting of stockholders in 2025.

Vote Required The Series A-1 Preferred Proposal would cause allaffirmative vote of the issued and outstandingholders of a majority of the shares of Series A-1 Preferred Stockstock present or represented by proxy and voting on the matter (which shares voting affirmatively also constitute at least a majority of the required quorum) is required to convert into common stock. Dueapprove this proposal. Recommendation of the Board of Directors The Board unanimously recommends that the stockholders vote “FOR” the approval, on an advisory (non-binding) basis, of the compensation paid by the Company to our NEOs. | | | | | | 2024 Proxy Statement | 15 |

TABLE OF CONTENTS Proposal 4—Approval of an Amendment to the limited liquidityCompany’s Current Charter to Declassify the Company’s Board of Directors